Answer:

Ans. He should pay $4,781.47 for this bond.

Step-by-step explanation:

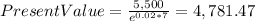

Hi, all we have to do is to bring to present value $5,500 at 2% per year compounded continuously, from year 7.

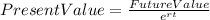

We have to use the following formula.

Where:

r = the compounded continuusly compounded rate

t = time to its maturity

It should look like this.

So, the fair price to pay for this bond is $4,781.47

Best of luck.