Answer:

it will need to sale 54.1 shaft per year to make it break even.

Step-by-step explanation:

To break even financially considering the time value of money we need to afford the equivalent annual cost which is, the PMT of the present worth:

present worth: sum of all cost:

invesmtent: lathe cost: 305,000

yearly cash outflow:

operator wages: 60,000 per year

maintenance cost: 25,000 per year

present value:

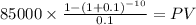

C 85,000

time 10

rate 0.1

PV $522,288.2040

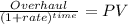

overheaul cost at year 6: 95,000

Overhaul: 95,000.00

time 6.00

rate 0.1

PV 53,625.02

Total invesmtent:

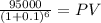

305,000 + 522,288.20 + 53,625.02 = 880,913.22

Now, we need to know a PTM which is equivalent to this cost to afford them and divide by the contribution per shafts:

PV $880,913.22

time 10

rate 0.1

C $ 143,364.570

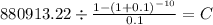

The equivalent annual cost of the project is 143,364.57 to break even we must cover this cost:

contribution per shaft: 2,850 - 200 = 2,650

annual cost of the investment: 143,364.57

shaft break even: 143,364.57 / 2,650 = 54.100