Answer: $300,000

Step-by-step explanation:

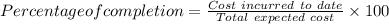

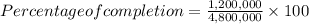

Total expected costs = cost incurred to date + estimated cost to complete

= 1,200,000 + 3,600,000

= 4,800,000

= 0.25

= 25%

Profit = contract revenue - Total expected costs

= $6,000,000 - 4,800,000

= $1,200,000

Cumulative gross profit = Profit × Percentage of completion

= $1,200,000 × 0.25

= $300,000

Therefore, Red Builders should have recognized profit at the end of year 1 in the amount of $300,000.