Answer:

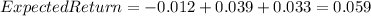

Ans. The expected rate of return on the Inferior Goods Co. stock is 5.90%

Step-by-step explanation:

Hi, you just have to multiply the expected earnings by the probability of occurance of a certain event and then add up all the products. Here is the information all organized to be processed.

Item Prob Earn

Booming 20% -6%

Normal 55% 7%

Recession 25% 13%

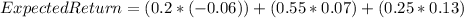

Ok, now let´s calculate the expected rate of return.

So the expected rate of return of the stock is 5.90%

Best of luck.