Answer:

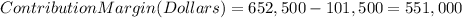

Ans. Homer´s contribution Margin is $551.000 , in percentage is 84.44%

Step-by-step explanation:

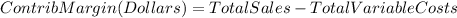

Hi, to find the contribution margin in dollars and in percentage we need to use two formulas.

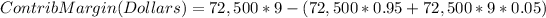

Now, here we have only two types of variable costs, the manufacturing cost of $0.95 per baseball and that 5% of sales revenue and those are the only costs we should be using, the other costs are fixed so there is no room for them in order to find the contribution margin.

It should look like this:

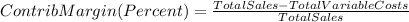

Now, in percentage:

So the contribution margin in dollars is $551,000, in percentage is 84.44%

Best of luck.