Answer:

present value: $ 987.22

future value: $ 1,259.97

Step-by-step explanation:

We will calculate the present value of each cash flow using the present value of a lump sum:

We calcualte and add them all to get the present value

Year Cash flow present value:

1 50 47.61904762

2 50 45.35147392

3 50 43.19187993

4 200 164.540495

5 400 313.4104666

6 500 373.1076983

987.2210613

(we use all decimals as we can't round)

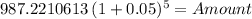

now to get the future value we could do it for each cash flow or bring the present value into the future:

Principal 987.2210613

time 5.00

rate 0.05000

Amount 1,259.97204