Answer:

option (A) $122,500

Step-by-step explanation:

Given:

Recorded assets = $1,140,000

Economic life = 8 years

lease term = 5 years

fair value at the end of 5 years = $420,000

Now,

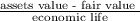

The Amortization expense =

or

The Amortization expense =

or

The Amortization expense = $122,500

Hence, the correct answer is option (A) $122,500