Answer:

present cost of the device: $ 114,634,777.81

Step-by-step explanation:

we are going to add a device worth 260 dollars on 100,000 cars three years from now, every year.

The cash outflow will be for: 260 x 100,000 = 26,000,000 every year

Timeline:

1st 2nd 3rd 4th 5th 6th 7th 8th 9th 10th)

<----/----/----/(/----/----/----/----/----/----/----/)---->

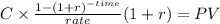

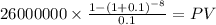

The first step is to calcualte the value of the annuity that begings in 3 years:

Notice during a seven years period it has 8 payment so it will be an annuity due:

C 26,000,000

time 8 years

rate 0.1

PV $152,578,889.2600

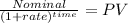

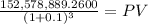

Now, we calcualte the present value of this annuity which begins 3 years from now:

1st 2nd Annuity-due

<----(/----/----/)--------->

We discount as a lump sum:

Nominal: 152,578,889.2600

time 3 years

rate 0.1

PV 114,634,777.81