Answer:

using fisher formula: 7.53%

simple-method: 7.4%

Step-by-step explanation:

the treasury bill will be a risk-free rate.

we will add the inflation premium to the real rate and get the nominal rate of the T-bill:

2.9 free-risk + 4.5 inflation premium = 7.4%

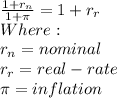

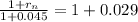

we could also solve using fisher formula for a more precise value:

rn = 1.029 x 1.045 -1 = 0.075305 = 7.53%