Answer:

The total variable cost is $88,000,000 .

The total fixed cost is $40,000,000.

Step-by-step explanation:

Cost of goods sold is $100,000,000.

Selling expenses is given as $16,000,000 .

Administrative expenses is given as $12,000,000.

Variable cost of goods sold is 70% of total cost of goods sold. While variable selling expenses is 75% of total selling expenses and variable administrative expenses is 50% of total administrative expenses.

Similarly, fixed cost of goods sold is 70% of total cost of goods sold. While fixed selling expenses is 75% of total selling expenses and fixed administrative expenses is 50% of total administrative expenses.

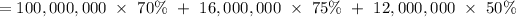

Total variable cost

= 70,000,000 + 12,000,000 + 6,000,000

=$88,000,000

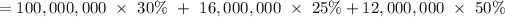

Total fixed cost

= 30,000,000 + 4,000,000 + 6,000,000

=$40,000,000