Answer:

1. Option (C) is correct.

2. Option (B) is correct.

Step-by-step explanation:

Given that,

On January 1, 2018

Legion Company sold = $200,000

Interest = 10% (Interest payable semiannually in June 30)

December 31, the bonds were sold = $177,000

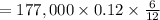

1. Interest expense recorded by legion for the six month ended June 30, 2018 is:

= $10,620

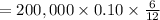

2. Interest paid by legion for the six month ended June 30, 2018 is :

= 10,000