Answer:

with the new rate we will pay in 58 months.

if there is 2% commision charge: 59.35 = 60 months

Step-by-step explanation:

Currently we owe 10,000

This will be transfer to a new credit card with a rate of 6.2%

We are going to do monthly payment of 200 dollars each month

and we need to know the time it will take to pay the loan:

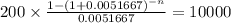

We use the formula for ordinary annuity and solve for time:

C $200.00

time n

rate 0.005166667 (6.2% rate divide into 12 months)

PV $10,000.0000

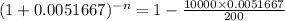

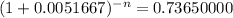

We arrenge the formula and solve as muhc as we can:

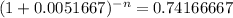

Now, we use logarithmics properties to solve for time:

![-n= \frac{log0.741667}{log(1+0.0051667)]()

-57.99227477 = 58 months

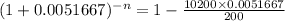

part B

If there is a charge of 2% then Principal = 10,000 x 102% = 10,200

we use that in the formula and solve:

![-n= \frac{log0.7365}{log(1+0.0051667)]()

-59.34880001 = 59.35 months