Answer:

13.41%

Step-by-step explanation:

Given:

Weight of debt =30% ; Weight of equity =70%; Coupon rate =12%

Risk-free rate,

=7% ; Expected market rate,

=7% ; Expected market rate,

=14.5% ; Beta,

=14.5% ; Beta,

= 1.20; Tax-Rate,

= 1.20; Tax-Rate,

=40%

=40%

We can calculate the following thus;

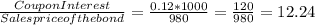

Return on bond =

%

%

Cost of debt =Return on bond *(1-

)=12.24% *(1-0.4)

)=12.24% *(1-0.4)

=12.24%*0.6 = 7.35%

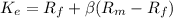

To compute the cost of equity capital

, we shall use the CAPM formula below

, we shall use the CAPM formula below

= 7% + 1.2(14.5%-7.0%)

= 7% +1.20( 7.5%) = 7% + 9% = 16%

The Weighted Average Cost of Capital, WACC is worked out as

WACC= (Weight of debt*Cost of debt) + (Weight of equity *Cost of equity)

= (30% *7.35) +(70% *16)

= 13.405

= 13.41%