Answer:

Bonds were issued at 636,338.5473

journal entries:

cash 636,339

discount on bonds 23,661

bonds payable 660,000

--to record issuance--

interest expense 15908

discount on bonds 2708

cash 13200

--to record first payment--

the attached image isthe amortization schedule

Step-by-step explanation:

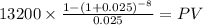

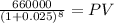

we will first calculate the present value of the cuopon payment and maturity at the market rate:

C 13,200

time 8

rate 0.025

PV $94,645.8106

Maturity 660,000.00

time 8.00

rate 0.025

PV 541,692.74

PV c $94,645.8106

PV m $541,692.7367

Total $636,338.5473

method on effective rate:

carrying value x market rate = interest expense

bonds face value x bond rate = cash procceds

difference: amortization

the amortization as this is discount will increase the carrying value of the bond after each payment