Answer:

The annual revenue of $7002.78 is required. The project is not financially viable.

Step-by-step explanation:

Total initial cost

= $23000

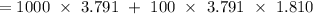

Total Salvage Value

=

=$1500

Operating cost = $1000 with a gradient of $100.

PV of operating cost

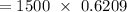

= 1000 (P/A,5,10%) + 100(P/G,5,10%)

=1000 (P/A,5,10%) + 100(P/A,5,10%) (A/G,5,10%)

= 3791 + 686.171

= $4477.171

PV of salvage value

= 1500(P/F,5,10%)

= $931.35

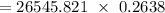

Hence NPV

= -23000 - 4477.171 + 931.35

= -$26545.821

Hence annual revenue to get $26545

= 26545.821(A/P,5,10%)

= $7002.78

Hence Annual Revenue = $7002.78

Since $6000 revenue is less than $7002.78, the project is not financially viable.