Answer:

the firm will have a loss of 6.414,97

Break-even rate = 11.34%

Step-by-step explanation:

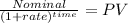

We calcualte the present value of a lump sum to know the present sale value:

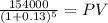

Nominal: 154,000

time 5 years

rate 0.13

PV 83,585.03

the current sale price 83,585.03

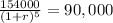

given a cost of (90,000)

the firm will have a loss of 6.414,97

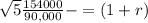

To break event the present value should be 90,000:

rate = 0.113411345 = 11.34%