Answer:

The marginal tax rate is 45%

The average tax rate = 19.17%

Step-by-step explanation:

Given:

Income Tax Rate

for income between $0 - $20,000 = 5%

for income between $20,000 - $50,000 = 20%

for income between $50,000 - $100,000 = 45%

for income between Over $100,000 = 55%

Income of the couple = $60,000

Since,

The income of the couple lies in the range of $50,000 - $100,000

therefore,

the marginal tax rate is 45%

Now,

For the average tax rate

Tax charged

for income between $0 - $20,000 = 5% of $20,000 = $1000

for income between $20,000 - $50,000 i.e $30,000 = 20% of $30,000

= $6,000

for income between $50,000 - $100,000 ( i.e $60,000 - $50,000=$10,000 )

= 45% of $10,000

= $4500

Total tax charged = $1000 + $6,000 + $4500 = $11,500

Therefore,

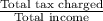

The average tax rate =

or

The average tax rate =

or

The average tax rate = 0.1917

or

The average tax rate = 0.1917 × 100% = 19.17%