Answer:

Present price of bond = $886.5165

Step-by-step explanation:

As for the information provided:

Coupon rate = 6% paid semiannually.

Interest = $1,000

= $30

= $30

Since paid semiannually, effective return rate = 8.16/2 = 4.08%

Time period = 7 years

2 = 14 periods

2 = 14 periods

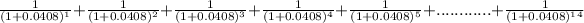

Future value of interest = Future annuity Value @ 4.08% for 14 periods =

= 10.50755

= 10.50755

Interest value = $30

10.50755 = $315.2265

10.50755 = $315.2265

Principal = $1,000

= $1,000

= $1,000

0.57129

0.57129

= $571.29

Present price of bond = $571.30 + $315.228 = $886.5165.