Answer:

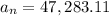

64,313.74 ; 95,559.38 ; 47,283.11

Step-by-step explanation:

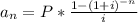

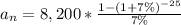

by definition the present value of an annuity is given by:

where

is the present value of the annuity,

is the present value of the annuity,

is the interest rate for every period payment, n is the number of payments, and P is the regular amount paid. so applying to this particular problem, we have:

is the interest rate for every period payment, n is the number of payments, and P is the regular amount paid. so applying to this particular problem, we have:

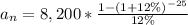

1. P=8,200, n=25, i=12%

2. P=8,200, n=25, i=7%

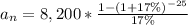

3. P=8,200, n=25, i=17%