Answer: 18,000

Step-by-step explanation:

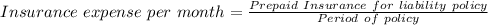

Liability policy:

= 2,000

Insurance expense 2018:

= No. of months from 1 Jan 2018 to 31 Dec 2018 × Insurance expense per month

= 12 × 2,000

= 24,000

Prepaid insurance balance for liability policy on 31 Dec, 2018:

= Prepaid Insurance for liability policy - Insurance expense 2018

= 36,000 - 24,000

= 12,000

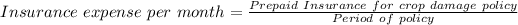

Crop damage policy:

= 500

Insurance expense 2018:

= No. of months from 1 Jan 2018 to 31 Dec 2018 × Insurance expense per month

= 12 × 500

= 6,000

Prepaid insurance balance for crop damage policy on 31 Dec, 2018:

= Prepaid Insurance for crop damage policy - Insurance expense 2018

= 12,000 - 6,000

= 6,000

Therefore,

Total prepaid insurance balance on 31 Dec 2018:

= Prepaid insurance balance for liability policy on 31 Dec, 2018 + Prepaid insurance balance for crop damage policy on 31 Dec, 2018

= 12,000 + 6,000

= 18,000