Answer:

$67.20

Step-by-step explanation:

Given:

Dividends paid, D₀ = $3.20

Growth rate = 5%

Required return rate = 10%

Now,

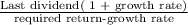

The expected value of the company’s stock

=

on substituting the respective values, we have

=

or

= $67.20

Hence, The correct answer is option $67.20