Answer:

Option (D) is correct.

Step-by-step explanation:

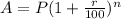

1.We use the formula:

where

A=future value

P=present value

r=rate of interest

n=time period.

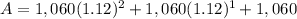

![A=1,060[(1.12)^(2)+(1.12)^(1) + 1]](https://img.qammunity.org/2020/formulas/business/college/8n4i7llyfjs27eqyd2q4mtwnpvcm3e9htp.png)

= 1,060 [1.2544 + 1.12 + 1]

= 1,060 × 3.3744

= $3,576.864

Therefore, the amount of $3,576.864 will Ashley have to buy a new LCD TV at the end of three years.

(b) Future value of annuity due = Future value of annuity × (1 + interest rate)

= $3,576.86(1 + 0.12)

= $3,576.86 × 1.12

= $4,006.08

She will save around $4,006.08