Answer:

Intrinsic value of the stock = $50

Step-by-step explanation:

Dividend paid in the upcoming year, D = $3

Dividends are expected to grow at the rate, g = 8% per year

Risk-free rate of return, Rf = 5%

Expected return on the market portfolio, Rm = 17%

Beta = 0.75

Intrinsic value of the stock, Po = ?

Calculating Cost of Equity (Ke)-

Ke = Rf + Beta (Rm - Rf)

Ke = .05 + 0.75 (0.17 - 0.05)

Ke = 0.05 + 0.09

= 0.14

Ke = 14%

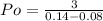

Calculating Intrinsic value of stock (P0)

Po = $50