Answer:

The highest affordable APR is 7.192%.

Step-by-step explanation:

A person wants to borrow $93,000 from local bank to buy a new sailboat.

The maximum affordable monthly payment or EMI is $1,850.

The loan period is 60 months.

Suppose, monthly interest rate = r

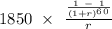

93000 =

At r =.6 %

Present value of loan repayment = $92984.94

At r=.5%

Present value of loan repayment = $95692.29

Through the method of interpolation,

r= .5% + ((95692.29 - 93000)/( 95692.29 - 92984.94))*(.6% - .5%)

r=.5994%

Annual interest Rate

= .5994%*12

= 7.192%.