Answer:

Today, the funder will invest 342,741.82 dollars

Step-by-step explanation:

We invest on a lump sum of STRIPS which yield 6% with semiannual compounding.

Our target is 550,000 in eight years and each STRIPS is valued at 5,000

The STRIP is the coupon payment or maturity payment of a bond which sales like a zero coupon bond so we need to discount the 550,000 at the market rate to know the market price of the STRIPS:

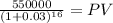

Maturity $550,000

time 16.00 (8 years x 2 compounts per year)

rate 0.03 ( 6% annual divide into 2 to get semiannual rate)

PV 342,741.82