Answer:

A quota of $ 583.388 every thre months is equivalent to these three deposits.

Step-by-step explanation:

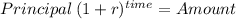

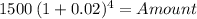

We need to first calculate the future value of the deposits

and then, we calculate the PMT which is equivalent

First deposit:

Principal $ 7,000

time 28 (7 years x 4 quarter per year)

rate 0.02 (8% over 4 = 2% quarterly)

Amount 12,187.17

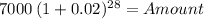

Second deposit:

Amount 8,236.71

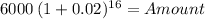

Third deposit:

Amount 1,623.65

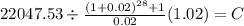

Total: 12,187.17 + 8,236.71 + 1,623.65 = 22,047.53

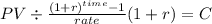

Now we solve for a PMT annuity-due (we are doing the first deposit at the beginning of the period)

FV $22,047.53

time 28 (7 years 4 quar a year)

rate 0.02 (8% per year divide into 4 = 2% quarterly)

C $ 583.388