Answer:

$5426.79

Step-by-step explanation:

Given that payments are made annually, then this is an annuity. Further, it is an ordinary annuity because all the payments occur at the end of each period.

The formula for the Future Value of an annuity is given as

FV of a annuity = P *

Where

P is the periodic payment

R is the rate of return per period

n is the number of periods

We are given that

P =$100

n= 4 quarters * 10 years =40

R = 6% annually. Quarterly rate = 6%/4 =1.5%

Thus, we substitute these values into the above formula as follows:

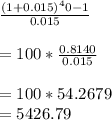

FV = 100 *

Thus, the FV = $5426.79