Answer: $36,173.622

Step-by-step explanation:

Cameron:

Annual Payment = $27,833

Time Period(n) = 44 years

Discount Rate(r) = 6%

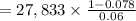

![Present\ Worth=Annual\ Payment*[((1-((1)/(1+r))^(n) )/(r)]](https://img.qammunity.org/2020/formulas/business/college/70ql5x2pstcicdsvgsalhta9la0oe7lwh0.png)

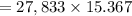

![Present\ Worth=27,833*[((1-((1)/(1.06))^(44) )/(0.06)]](https://img.qammunity.org/2020/formulas/business/college/rl1rofz78d8kt0x1obkjct1fdni74haii7.png)

= $427,709.711

Kennedy:

Annual Payment = $27,833

Discount Rate = 6%

Present Worth =

Present Worth = $463,883.333

So, Present Worth of Kennedy is $36,173.622 more than that of Cameron.