Answer:

weight of A = 0.4516

weight of B = 0.5483

Step-by-step explanation:

given data

A rate of return = 12% = 0.12

A standard deviation = 17% = 0.17

B rate of return = 9% = 0.09

B standard deviation = 14% = 0.14

to find out

The weights of A and B in the global minimum variance portfolio

solution

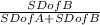

we find here weight by given formula that is

weight A =

..........................1

..........................1

here SD is standard deviation

so put here value for weight A

weight A =

weight A = 0.4516

and

weight of B = 1 - weight of A

weight of B = 1 - 0.4516

weight of B = 0.5483