Answer:

maximum Southern Tours should pay today to acquire Holiday Vacations is $506518.12

Step-by-step explanation:

given data

cash flows 1 = $187,000,

cash flows 2 = $220,000

cash flows 3 = $250,000

rate of return = 13.5 % = 0.135

to find out

maximum Southern Tours should pay today to acquire Holiday Vacations

solution

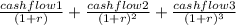

we will apply here formula of PV for all 3 cash flow that is express as

PV =

............................1

............................1

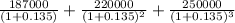

here r is rate of return so put here value we get

PV =

solve it we get

PV = $506518.12

so maximum Southern Tours should pay today to acquire Holiday Vacations is $506518.12