Answer:

1. 18,750

2. $187,500

3. 28,750

4. $275,000

5. 27,679 or $276,790

Step-by-step explanation:

As for the provided information, we have,

Sale price per unit = $10

Variable cost per unit = $6

Contribution per unit = $4

Thus, contribution margin = $4/$10 = 40%

Fixed cost = $75,000

Therefore,

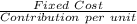

1. Break Event Point in Units =

=

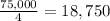

2. Break Even in Sales =

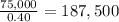

3. Before tax profit = $40,000

Net to be recovered from contribution = $40,000 + $75,000 = $115,000

Thus, units required =

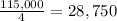

4. Sales in dollars for profit before tax of $35,000

Thus, net to be recovered as a contribution margin = $35,000 + $75,000 = $110,000

Sales in Dollars =

5. After tax profit = $25,000

Tax rate = 30%

Profit before tax =

Total to be recovered from contribution = $35,714.29 + $75,000 = $110,714.29

Sales in units = $110,714.29/4 = 27,679

Sales in dollars = 27,679

10 = $276,790

10 = $276,790