Answer:

nominal tax shield in year 10: 6,812 dollars

present value of the tax shield: 1,837.49

Step-by-step explanation:

the nominal tax shield in year 10:

We look into the MACRS table for 10-years property class: 6.55%

The depreciation expense for this year is 260,000 x 6.55% = 17,030

Then this produces a tax shield of 40% 6,812

The nominal tax shield at year 10 is 6,812 dollars

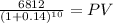

considering time value of money today this tax shield is worth:

PV: 1,837.49