Answer:

$2400 in A rated bond and $3000 in B rated bond.

Explanation:

We have been given that Maria has recently retired and requested an extra $444.00 per year in income.

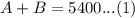

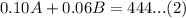

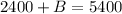

We can represent this information in an equation as:

She has $5400 to invest in an A-rated bond that pays 10% per annum or a B-rated bond paying 6% per annum.

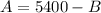

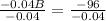

From equation (1), we will get:

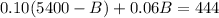

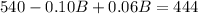

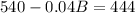

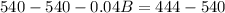

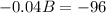

Substitute this value in equation (2):

Therefore, Maria should invest $2400 in A-rated bond.

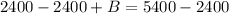

Substitute

in equation (1):

in equation (1):

Therefore, Maria should invest $3000 in B-rated bond.