Answer:

Return of investment = 44.5%

Explanation:

Number of shares purchased by Tamara = 1500

Offer price per share = 7. 08

Total amount spent on purchasing shares = 1500 × 7.08 = 10620

Dividend receive per share = 0.21

Total dividend received on 1500 shares = no. of shares × dividend received per share

Total dividend received = 1500 × 0.21 = 315

Selling price per share = 10.02

Amount received by Tamara by selling the investment = no. of shares × selling price per share

Amount received by Tamara by selling the investment

= 1500 × 10.02

= 15030

Now, Net profit received on investment = S.P of Investment + Dividend received - C.P of investment

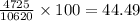

Net profit = 15030 + 315 - 10620 = 15345 - 10620 = 4725

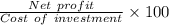

Return on investment =

=

≈ 44.5 %