Answer:

the net present value at a rate r = 9% is $91,0.2.61478

Step-by-step explanation:

From data given the initial investment calculated as

The initial investment is

17,000,000-5,000,000 = 12,000,000

Hence at year 0, the company has a cash flow of

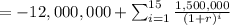

And for the next 15 years the cash flows are:

CF_i= 1,500, 000 for i 1, 2, .., 15

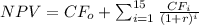

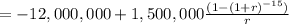

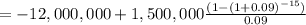

Hence the net present value at a rate r = 9% is:

= 91,0.2.61478

Since NPV >0 then they should purchase the new engines.

They should purchase the new engines because it would result in a rate of return

greater than the rate of 9% of the other investment.