Answer:

Price of the bond is $104,236,860.

Step-by-step explanation:

Given:

Coupon rate is 6% or 0.06

Face value = $119,000,000

Coupon payment each year = 0.06×119,000,000

= $7,140,000

Yield to maturity = 7% or 0.007

Maturity period = 30 years

Price of bond = Present value of face value + present value of coupon payment (annuity)

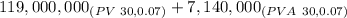

Price of bond =

PV of $1 for 7%,30 periods = 0.1314

PVA of $1 for 7%,30 periods = 12.409

Substitute the values in above formula:

Price of bond = (119,000,000 × 0.1314) + (7,140,000 × 12.409)

= 15,636,600 + 88,600,260

= $104,236,860

There will be slight difference in final answer as present value table is used. Excel spreadsheet gives an accurate answer.

So, price of bond is $104,236,860