Answer:

Year 1 = $1,100

Year 2 = $1,330

Year 3 = $1,550

Year 4 = $2,290

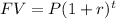

(a) If the discount rate is 6 percent, then the future value of these cash flows in Year 4:

To solve this problem, we must find the FV of each cash flow and add them. To find the FV of a lump sum, we use:

= $6737.51

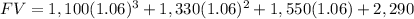

(b) If the discount rate is 14 percent, then the future value of these cash flows in Year 4:

= $7415.17

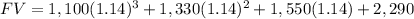

(c) If the discount rate is 21 percent, then the future value of these cash flows in Year 4:

= $8061.47