Answer: $147,000

Step-by-step explanation:

Cost of sales is a variable cost.

Selling and administrative costs:

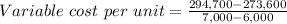

= $21.10 per unit

Fixed cost = Total cost - Variable cost element

= $294,700 - ($21.10 per unit × 7,000 units)

= $294,700 - $147,700

= $147,000