Answer:

Itis better to take the case in hand of 207,000,000 millions

Step-by-step explanation:

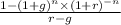

We need to calcualte the present value of a geometric annuity-due

g 0.05

r 0.04

C 4,515,432

n 26

n 26

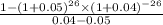

127,557,727.45

As is an annuity due, we multiply by (1+r)

127,557,727.45 x (1+0.04) = 132,660,036,548

The present value of the 207,000,000 option is better as the annuity present value is around 130,000,000