Answer:

after the first quota carrying value: 16.360,85

after the fourht quota carrying value: 4,442.34

Step-by-step explanation:

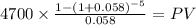

we calculate the present valeu of the payment to know the value of the car:

C 4,700

time 5

rate 0.058

PV $19,906.29

Nowe to know the princpal after first payment we need to know the first quoa maortization:

19,906.29 x 0.058 = 1,154.56 interest

quota - interest

4,700 - 1,154.56 = 3,545.44

19,906.29 - 3,545.44 = 16.360,85

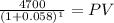

now the last cuota, the discounted value of the cuopa will be the amount of principal we owe as afterthis payment the loan is cancelled.

Maturity 4,700.00

time 1.00

rate 0.058

PV 4,442.34