Answer:

1) payment of $ 78,867.70

2) payment of $ 62,614.11

3) 7 years

4) rate of 12%

Step-by-step explanation:

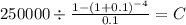

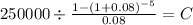

On the first and second point we need to solve for the PMT:

PV $250,000.00

time 4

rate 0.1

C $ 78,867.701

PV $250,000.00

time 5

rate 0.08

C $ 62,614.114

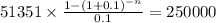

In the third one we need to solve for time:

C $51,351.00

time n

rate 0.1

PV $250,000.0000

we work to reach this expression:

ANd we acn use logarithmics properties to solve for n

[tex]-n= \frac{log0.51315456368912}{log(1+0.1)

-n = -7.000072677

n = 7 years

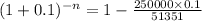

Lastly, on the fourth, we need to solve for the rate, which is done using excel if we want an exact result and save time.

we list each value.

-250,000

104, 087

104, 087

104, 087

And calculate IRR by selecting this values.

12.0%