Answer:

(a) We have not significant evidence to show that the software company's claim of a minimun of 20 percent in cost savings was not valid

(b) a 95% confidence interval for the average cost-saving yield is (17.5283, 20.4917)

Explanation:

Let X be the random variable that represents a cost-saving yield (in percent) during the first year of operation of the software for a firm. We have observed n = 10 values,

= 19.01 and s = 2.0712. We suppose that X is normally distributed.

= 19.01 and s = 2.0712. We suppose that X is normally distributed.

(a)

We have the following null and alternative hypothesis

vs

vs

(lower-tail alternative)

(lower-tail alternative)

We will use the test statistic

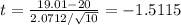

and the observed value is

and the observed value is

if

is true, then T has a t distribution with n-1 = 9 degrees of freedom.

is true, then T has a t distribution with n-1 = 9 degrees of freedom.

p-value = P(T < -1.5115) = 0.0825

We can use a table from a book or a programming language to find this probability P(T < -1.5115).

You can use the instruction pt(-1.5115, df = 9) in the R statistical programming language.

Because the p-value is greater than 0.05 (0.0825 > 0.05) we fail to reject the null hypothesis at the level of significance of 0.05.

(b)

We will use

as the pivotal quantity. T has a

distribution with n-1 = 9 degrees of freedom. Then, as we want a 95% confidence interval for the average cost-saving yield estimate, we should find the 2.5th quantile of the t distribution with 9 degrees of freedom, i.e.,

distribution with n-1 = 9 degrees of freedom. Then, as we want a 95% confidence interval for the average cost-saving yield estimate, we should find the 2.5th quantile of the t distribution with 9 degrees of freedom, i.e.,

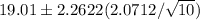

, this value is -2.2622. Therefore the 95% confidence interval is given by

, this value is -2.2622. Therefore the 95% confidence interval is given by

, i.e.,

, i.e.,

(17.5283, 20.4917)

To find the 2.5th quantile of the t distribution with 9 degrees of freedom, you can use a table from a book or the next instruction in the R statistical programming language

qt(0.025, df = 9)