Answer:

Annuity will be $33112.644

Step-by-step explanation:

We have given future value ( FV ) = $4000000

Rate of interest r = 5% = 0.05

Number of periods n = 40

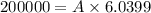

We know that future value is given by

![Futurte\ value(FV)=(A)/(r)[(1+r)^n-1]](https://img.qammunity.org/2020/formulas/business/college/jcwxggvqi02ynr0440yyn6wfywoe09kif4.png)

Here A is annuity

So

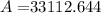

![4000000=(A)/(0.05)[(1+0.05)^(40)-1]](https://img.qammunity.org/2020/formulas/business/college/ievudebctf2gex4zueufcun7l4l9zynlqn.png)

![200000=A[(1+0.05)^(40)-1]](https://img.qammunity.org/2020/formulas/business/college/de7qj5mrv6caw8duw5kfn7yrkn0bi4cks1.png)

So annuity will be $33112.644