Answer:

$985.92

Explanation:

In order to solve this question, we are going to use two formulas.

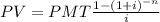

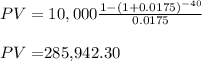

Present Value of an Annuity

To get the value of the pension of 10,000 per quarter for 10 years. And

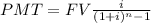

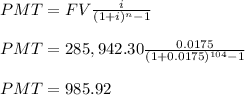

Sinking funds Payments Formula

to get the Payment to be deposited each quarter during 26 years.

So for the first formula

n= number of periods = we need to know how many quarters in 10 years are. We know there are 4 quarters in a year, so 10 years multiplied by 4 is 40 quarters

n= 40

For i=interest rate= it is 7% compounded quarterly. There are 4 quarters so we divide by 4 and we get:

i=7%/4=1,75%

PMT= 10,000

and these 285,942.30 would be our future value in the sinking fund payment formula with:

n= 26 years *(4 quarters a year)= 104 quarters

i=1.75%

FV=$285,942.30

And $985.92 would have to be deposited every quarter during 26 years to get a payment of $10,000 per quarter for 10 years.