Answer:

5%

Explanation:

This is a significance test for a mean.

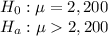

The 2 hypothesis here will be:

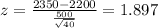

To determine the z-score of the error in the means you have to use this formula:

This mean that if the z score of a significance level is less than 1.897 the hypothesis that μ>2,200 is suggested.

10% -> z= 1.28

5% -> z = 1.645

1% -> z = 2.33

The most restrictive level of significance is 5%