Answer:

Equivalent annual cost: -43,685.255

Step-by-step explanation:

the EAC equivalent annual cost of the PTM of the present value of the machine at the given discount rate.

for the equivalent annual cost, first we must calculate the net present value

57,000 investment

+ present value of fuel and maintenance

+ present value of dismantling cost

fuel expense: 4,000 x 7.5 = 30,000

maintenance expense 400

total 30,400

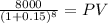

C 30,400

time 8

rate 0.15

PV $136,414.5738

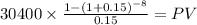

then the present value of a lump sum for the dismantling cost

Maturity 8,000.00

time 8.00

rate 0.15

PV 2,615.21

57,000 + 136,414.5738 + 2,615.21 = 196,029.7838

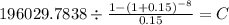

Now we calculate the PMT of an annuity of 8 year at 15% discount rate:

PV $196,029.78

time 8

rate 0.15

C $ 43,685.255

This will bethe equivalent annual cost.