Answer:

Option (B) is correct.

Step-by-step explanation:

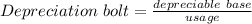

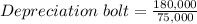

Depreciable base = Cost - Residual Value

= $190,000 - $10,000

= $180,000

Usage = 75,000 bolts

= $2.40

For Year 1:

Book value = $190,000

Usage = 15,000 bolts

Depreciation expense = Usage × Depreciation bolt

= 15,000 × $2.40

= $36,000

Ending Book Value = Book value - Depreciation expense

= $190,000 - $36,000

= $154,000

Accumulated Depreciation = $36,000

For Year 2:

Book value = $154,000

Usage = 19,000 units

Depreciation expense = Usage × Depreciation bolt

= 19,000 × $2.40

= $45,600

Ending Book Value = Book value - Depreciation expense

= $154,000 - $45,600

= $108,400

Accumulated Depreciation = Depreciation expense Year 1 + Depreciation expense Year 2

= $36,000 + $45,600

= $81,600