Answer:

We will pick the highest rate, which is 18% annually

effective rate of 0.04% compounded daily: 15.72%

Step-by-step explanation:

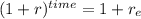

we will calculate the equivalent rate for each alternative:

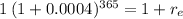

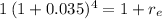

daily: 0.040%

time 365.00 (365 days per year)

rate 0.040% = 0.04/100 = 0.00040

effective: 0.1572 = 15.72%

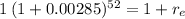

weekly 0.285

there are 52 week per year

effective rate: 0.15950 = 15.95%

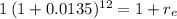

monthly 1.35%

12 months per year

effective rate = 0.17459 = 17.46%

quarterly: 3.5%

four quarter per year

effective rate = 0.14752 = 14.75%

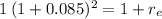

semiannually 8.5%

dos half

effective rate = 0.17723 = 17.72%

annual of 18%

We will pick the highest rate, which is 18% annually