Answer:

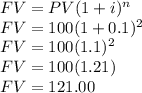

a) $121.00

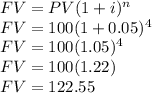

b) $121.55

Explanation:

We use the formula of Future Value

a) Future value of a deposit of $100 with an interest rate of 10% compounded annually

PV=100

i=10%

n= 2 years

b) Future value of a deposit of $100 with an interest rate of 10% compounded semiannually

PV=100

i=10%/2=5% (When compounding semiannually, the rate is divided by the number of semesters in a year, in this case 2)

n= 4 semesters

Basically, the difference is the number of periods n, in a) n=2: (1+i)^2 and in b) n=4: (1+i/2)^4.

The more n, the more the future value.