Answer:

OPTION C i.e 11%

Option A i.e 30.55 year

Step-by-step explanation:

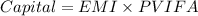

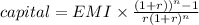

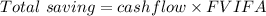

we know that capital can be calculated as

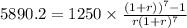

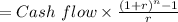

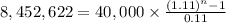

from the data given in question we can calculate the value of r

so

solving for r we get

r = 11%

option C

we know that

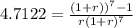

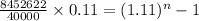

from the data given we can evealueate the value of n

solving for n we get

n = 30.55 year.

Option A